Critical

returns

Targeting the root cause of high-costs.

We move

where it matters.

We are here to close the gap in access and outcomes across critical industries—starting with healthcare and productivity. We help founders unlock distribution channels early and efficiently and run best-in-class fundraising processes, from cap table management and pitch readiness to targeted VC introductions.

Clinically diagnosed mental disorders cost the U.S. over $300Bn per year.*

So we invest in clinically-driven tech companies targeting those disorders by improving access to therapists and medications.

The initial success rate of IVF for U.S. families is 21.3%, leading to elevated costs that exceed over $10K on average, even with insurance coverage (offered by only 22 states as of 2024).*

So we invest in software that expands access to fertility care and helps reproductive endocrinologists streamline patient management, improve clinical decision-making, and deliver better care at scale.

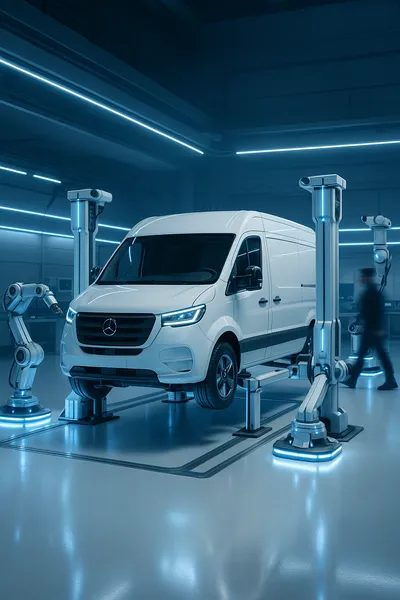

99.9% of U.S. businesses are small businesses, yet over 40% still use paper or spreadsheets for daily operations.*

So we invest in solutions that bring modern software and automation to Main Street—industries like auto repair, logistics, and food service that have been historically overlooked by tech.

Who we

believe in

We partner with founders who are equal parts daring and self-aware— the ones who look for deep-rooted problems where the masses tend to look away. Through early funding and ongoing collaboration, we enable their creative solutions, so they can deliver positive outcomes to our frontline workers, our communities, and our future.

How we partner

We supply seed funding so solutions can take root. Our strategy moves bottom lines, and shatters the status quo, producing outcomes in sectors that are often overlooked. Our sweet spot is post first customer, but pre product market fit.

Our approach

Investment at

pre-seed/seed

To multi-stage investors

and mid-size customers

support

Operating model

deep dives

From top operators that we've built

working relationships with

Our investment

thesis at a glance

We invest pre-seed and seed in technical teams tackling root-cause cost challenges in critical industries.

We focus on two sectors crucial to long-term growth and stability: healthcare and Main Street productivity.

We typically enter post product but pre product market fit, supporting teams to accelerate distribution and prepare for scale.

We differentiate through hands-on, operator-level support that helps founders achieve milestone wins early—whether it’s their first customer, first hire, or first institutional round.